Commentary on the aggregated balance sheet of investment funds

December 2025

Commentary on the aggregated sectoral balance sheet

Net assets value

The net assets value of investment funds was CZK 2,006.1 billion at the end of December. This means an increase of CZK 21.1 billion compared to November (monthly transactions accounted for CZK +14.5 billion). Compared to the same period last year, the net assets value of investment funds rose by 33.1%. The biggest month-on-month change in the net assets value was recorded for real estate funds, up by CZK 8.8 billion to CZK 365.6 billion.

Investment in bonds

The value of bond holdings was CZK 421.9 billion at the end of December. Compared to the previous month, the total volume of bonds in the funds’ portfolio increased by CZK 8.2 billion (monthly transactions accounted for CZK +6.9 billion). The proportion of debt securities in the funds’ net assets value went up to 21.0% compared to the previous month.

Investment in equity securities

The volume of equity securities in the funds’ portfolio increased in the month under review. As of the end of the month, the value of holdings of equity securities amounted to CZK 1,122.4 billion, of which CZK 421.6 billion was investment in the shares and units of investment funds and CZK 700.8 billion was investment in shares and other equity. The value of equity securities grew by CZK 17.2 billion compared to November (monthly transactions accounted for CZK +11.9 billion). The proportion of equity securities in the funds’ net assets value increased to 55.9% compared to the previous month.

Other investment

The value of funds invested in other assets decreased during the period under review. The total volume of other investment was CZK 545.7 billion in December, of which CZK 87.2 billion was fixed investment and CZK 111.5 billion investment in deposits. The proportion of other investment in the funds’ net assets value fell to 27.2% compared to the previous month.

Reporting population

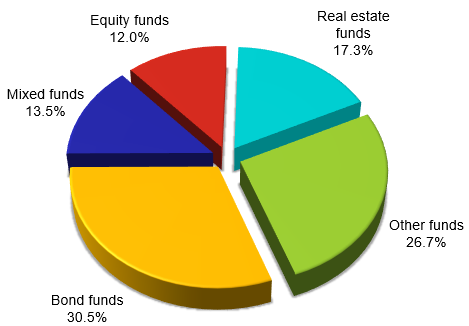

At the end of December 2025, a total of 793 resident investment funds were active in the Czech Republic, of which 121 were equity funds, 73 bond funds, 70 mixed funds, 167 real estate funds and 362 other funds.

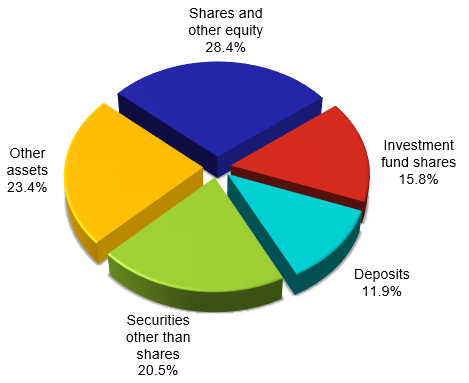

Chart 1 – Balance sheet total – breakdown by asset item

Source: ARAD data series system

Chart 2 – Net assets value – breakdown by investment policy

Source: ARAD data series system

Notes:

- In December 2025, entities were reclassified and the list of investment funds used for statistical purposes was adjusted in accordance with a recasted Regulation on investment fund statistics (ECB/2024/17). Investment funds with variable/fixed registered capital that establish sub-funds were newly classified as financial auxiliaries and are not included in this list.

- Investment funds mean investment and mutual funds other than money market funds. In accordance with Regulation of the European Central Bank concerning the balance sheet of the monetary financial institutions sector (ECB/2013/33), money market funds fall into this sector and the data for money market funds are not part of the investment fund statistics.

- Transactions mean changes in stocks which occurred during the relevant period owing to purchases/sales of the given instrument. Monthly transactions are calculated from differences in outstanding amounts adjusted for reclassifications, price changes, exchange rate variations and other changes which do not arise from financial transactions (non-transaction effects).

- Other investment is understood to mean funds invested in assets other than bonds and equity securities (especially deposits, loans and real estate).

- The time series for investment fund statistics are available in the ARAD time series system.