Commentary on the aggregated balance sheet of investment funds

May 2024

Commentary on the aggregated sectoral balance sheet

Net assets value

The net assets value of investment funds was CZK 1,314.8 billion at the end of May. This means an increase of CZK 22.8 billion compared to April (monthly transactions accounted for CZK +17.1 billion). Compared to the same period last year, the net assets value of investment funds rose by 30.4%. The biggest month-on-month change in the net assets value was recorded for bond funds, up by CZK 6.9 billion to CZK 397.7 billion.

Investment in bonds

The value of bond holdings was CZK 303.2 billion at the end of May. Compared to the previous month, the total volume of bonds in the funds’ portfolio increased by CZK 2.5 billion (monthly transactions accounted for CZK +3.5 billion). The proportion of debt securities in the funds’ net assets value declined to 23.1% compared to the previous month.

Investment in equity securities

During the month under review, the volume of equity securities in the funds’ portfolio increased. As of the end of the month, the value of holdings of equity securities amounted to CZK 652.4 billion, of which CZK 238.2 billion was investment in the shares and units of investment funds and CZK 414.2 billion was investment in shares and other equity. The value of equity securities grew by CZK 9.0 billion compared to April (monthly transactions accounted for CZK +6.9 billion). The proportion of equity securities in the funds’ net assets value declined to 49.6% compared to the previous month.

Other investment

The value of funds invested in other assets increased in the period under review. The total volume of other investment was CZK 440.3 billion in May, of which CZK 71.8 billion was fixed investment and CZK 141.8 billion was investment in deposits. The proportion of other investment in the funds’ net assets value increased to 33.5% compared to the previous month.

Reporting population

At the end of May 2024, a total of 849 resident investment funds were active in the Czech Republic, of which 94 were equity funds, 72 bond funds, 74 mixed funds, 143 real estate funds, 442 other funds and 24 funds without an investment policy.

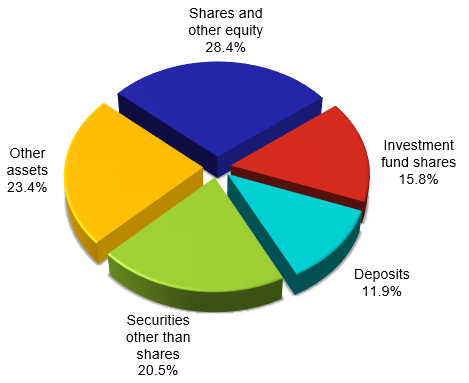

Chart 1 – Balance sheet total – breakdown by asset item

Source: ARAD data series system

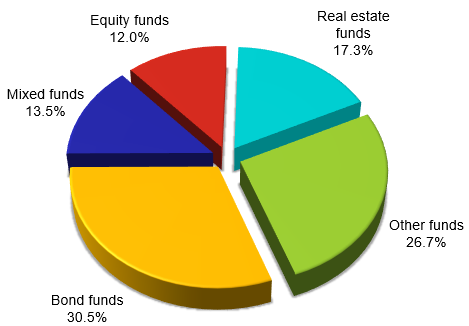

Chart 2 – Net assets value – breakdown by investment policy

Source: ARAD data series system

Notes:

- Investment funds mean investment and mutual funds other than money market funds. In accordance with Regulation of the European Central Bank concerning the balance sheet of the monetary financial institutions sector (ECB/2013/33), money market funds fall into this sector and the data for money market funds are not part of the investment fund statistics.

- Transactions mean changes in stocks which occurred during the relevant period owing to purchases/sales of the given instrument. Monthly transactions are calculated from differences in outstanding amounts adjusted for reclassifications, price changes, exchange rate variations and potential other changes which do not arise from financial transactions (non-transaction effects).

- Other investment is understood to mean funds invested in assets other than bonds and equity securities (especially deposits, loans and real estate).

- The time series for investment fund statistics are available in the ARAD data series system.