Banking statistics

May 2024

Commentary on the main indicators

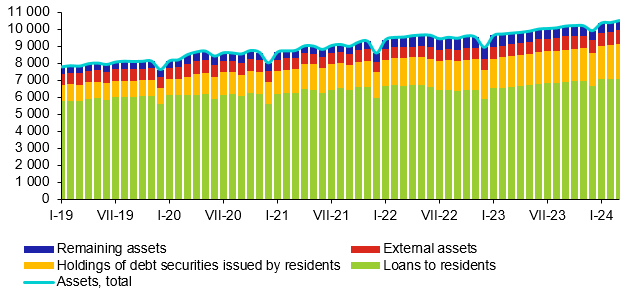

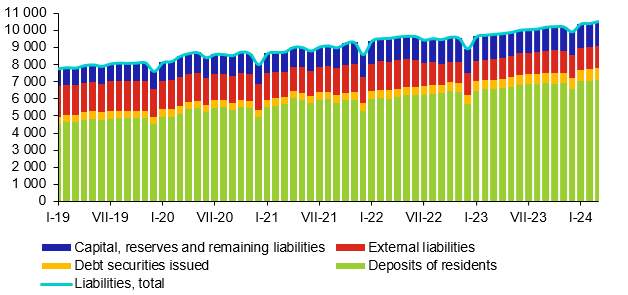

The total assets of the Czech banking sector stood at CZK 10,536 billion at the end of May 2024, down by CZK 35 billion month on month. Loans to residents are the predominant asset item. Their volume reached CZK 7,165 billion. Deposits of residents, which are the most important item among banking sector liabilities, totalled CZK 7,138 billion.

Chart 1 – Assets of the banking sector (CZK billions)

Source: ARAD data series system

Chart 2 – Liabilities of the banking sector (CZK billions)

Source: ARAD data series system

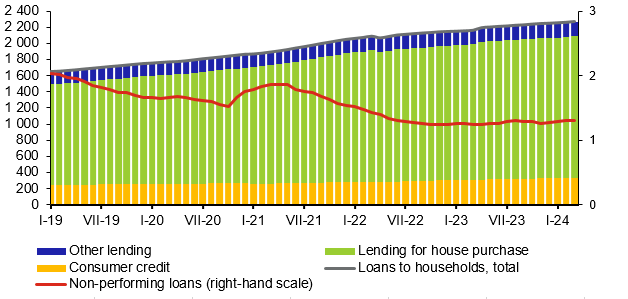

The volume of loans to resident households amounted to CZK 2,290 billion in May 2024 and increased by 0.5%, or CZK 12 billion month on month. As regards the breakdown of loans to this sector by purpose, loans for house purchase were the largest item (CZK 1,770 billion in May, up by 0.5% month on month). They accounted for 77% of the total volume of loans to households. The volume of non-performing loans increased marginally to CZK 30.0 billion in May. Their share in total loans has been unchanged at 1.3% since May 2023.

Chart 3 – Loans to resident households by purpose (CZK billions) and the share of non-performing loans (%)

Source: ARAD data series system

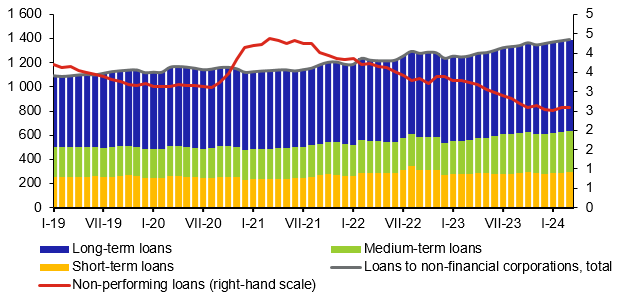

Turning to the structure of loans to resident non-financial corporations by original maturity (which totalled CZK 1,390 billion in May 2024, down by 0.5%, or CZK 7 billion month on month), long-term loans still have the largest share. The volume of long-term loans amounted to CZK 751 billion in May (54% of the total volume of loans to the sector). The volume of non-performing loans stood at CZK 36.1 billion in May (down by CZK 0.2 billion month on month) and their share in total loans was 2.6%, unchanged from the previous three months.

Chart 4 – Loans to resident non-financial corporations by original maturity (CZK billions) and the share of non-performing loans (%)

Source: ARAD data series system

Notes

- In May 2024, the banking statistics in the Czech Republic were compiled from the source statistics of 46 banks and foreign bank branches active in the Czech Republic (excluding the CNB).