Commentary on the quarterly aggregated balance sheet of pension funds

as of 31 December 2023

Commentary on the aggregated sectoral balance sheet

The balance sheet total of pension funds amounted to CZK 618.1 billion as of 31 December 2023. This represents an increase of CZK 10.5 billion compared with the previous quarter. Quarterly transactions stood at CZK 2 billion. Compared with the same period last year, the balance sheet total rose by CZK 18.2 billion (or 3%) year on year.

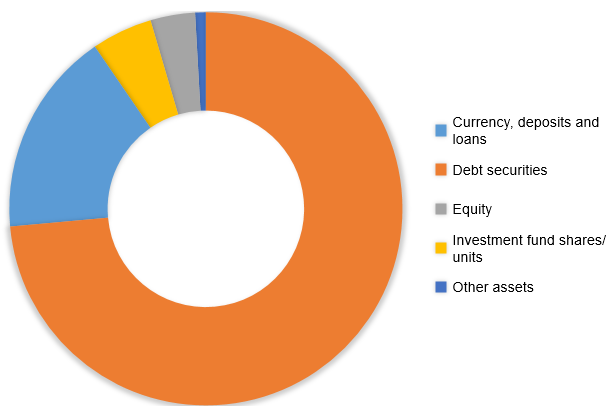

Debt securities had the largest share in the structure of pension funds’ assets (73.6%). They stood at CZK 454.7 billion at the end of September, a decrease of CZK 5.9 billion compared with the previous quarter. Investments in government bonds accounted for CZK 414.4 billion and investments in bonds of monetary financial institutions for CZK 21.4 billion of the total volume of bonds. As regards the country of the issuer, bonds issued by Czech entities are predominant. Their share in total bonds held was slightly above 90% in the period under review. Deposits and loans provided are another important item on the asset side. They increased to CZK 104.4 billion in the period under review. This represents 16.9% of total assets.

Equity securities grew by CZK 7.8 billion to CZK 53.7 billion in the period under review. Quarterly transactions amounted to CZK 4.1 billion. Listed shares accounted for CZK 22.3 billion, unlisted shares for CZK 0.4 billion and investment fund shares and units for CZK 31 billion of total equity securities.

Pension entitlements, i.e. the capital that pension funds hold in order to meet the future pension claims of their participants, are the largest item on the liabilities side. They amounted to CZK 585.8 billion as of 31 December 2023, an increase of CZK 1.1 billion compared with the previous quarter and an increase of CZK 2.4 billion on a year earlier.

Chart – Balance sheet total – breakdown by asset items

Source: ARAD data series system

Notes:

- Pension funds (PFs) are participation or transformed funds whose assets are managed by pension management companies and that are residents of the Czech Republic.

- Net value of financial transactions in the given quarter calculated by adjusting the difference between end-of-period levels for non-transaction effects.