Commentary on MFI interest rates

March 2024

Interest rates on new business

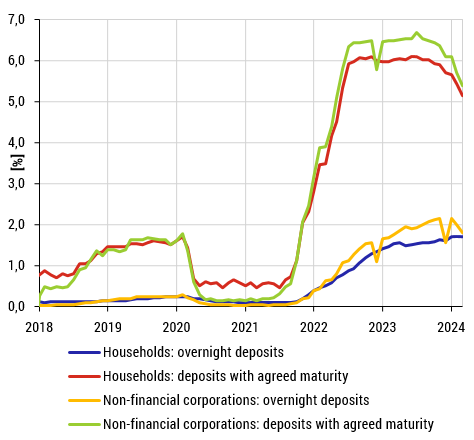

Interest rates on new deposits of households recorded the largest change for deposits with agreed maturity in March. Deposits in this category also saw the largest change among non-financial corporations.

The interest rate on household deposits with agreed maturity declined by 0.27 percentage point to 5.16%. The interest rate on overnight deposits edged down to 1.70%. The interest rate on current account deposits declined to 0.23%. The interest rate on deposits redeemable at notice decreased to 2.56% (this rate is the only one to include, in addition to the household sector, also similar deposits of non-financial corporations, whose volumes are negligible in this category).

The rate on deposits of non-financial corporations with agreed maturity fell by 0.31 percentage point to 5.39%. The interest rate on overnight deposits decreased to 1.81%. The interest rate on current account deposits declined to 0.97%. Deposits with agreed maturity of up to one year (which as a rule account for 100% of all deposits with agreed maturity in this sector) were remunerated at a lower rate (5.39%).

Chart 1 – Interest rates of commercial banks on CZK deposits held by Czech residents – new business

Source: ARAD data series system

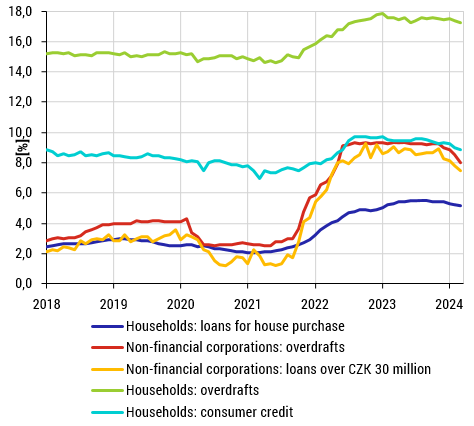

Within interest rates on new loans to households, the biggest change was recorded for other loans in March. Within interest rates on loans to non-financial corporations, the biggest change was recorded for overdrafts.

The overall interest rate on consumer credit, loans for house purchase and other loans fell to 6.40%. The interest rate on consumer credit declined month on month to 8.83%. The interest rate on loans for house purchase fell to 5.16%. The interest rate on building society loans decreased to 6.25%. The interest rate on mortgage loans dropped slightly to 5.05%, down by 0.10 percentage point on a year earlier. The rate on other loans decreased by 0.39 percentage point to 5.90%. The interest rate on overdrafts and revolving loans dropped to 15.34%. Within this category, the interest rate on overdrafts fell to 17.25%. The interest rate on credit cards fell to 16.90%.

Interest rates on new loans to non-financial corporations (excluding overdrafts, revolving loans and credit cards) decreased to 7.41%. The rate on loans of up to CZK 7.5 million was down to 7.46%. The rate on loans of over CZK 7.5 million and up to CZK 30 million fell to 6.80% and the rate on new loans of over CZK 30 million decreased to 7.50%. The interest rate on overdrafts, revolving loans and credit card loans was down to 7.86%. The interest rate on overdrafts stood at 8.01%, down by 0.49 percentage point.

Chart 2 – Interest rates of commercial banks on CZK loans provided to Czech residents – new business

Source: ARAD data series system

Interest rates on outstanding amounts

The average interest rates on outstanding amounts of deposits of households changed by just a few tenths of a percentage point in March. More pronounced changes were recorded for non-financial corporations.

The average changes in interest rates on outstanding amounts of loans to households were just a few basis points in March. Interest rates on outstanding amounts of loans to non-financial corporations saw larger changes.

The overall interest rate on loans to households increased to 4.17%. The interest rate on loans for house purchase also rose, reaching 3.29% (with the rate on outstanding amounts of mortgage loans picking up to 3.14%). The rate on consumer credit dropped to 8.73% and the rate on other loans increased marginally to 4.65%.

The average interest rate on loans to non-financial corporations fell to 6.76%. The rate on loans with maturity of up to one year decreased to 8.01%. The rate on loans with maturity of over one year and up to five years declined to 7.84%. The rate on loans with maturity of over five years dropped to 5.90%.

Notes:

- Interest rate statistics are based on Regulation of the European Central Bank on interest rates applied by monetary financial institutions to deposits and loans vis-à-vis households and non-financial corporations (ECB/2013/34) (pdf, 1 MB).

- Interest rates are converted to an annual basis and quoted in percentages per annum. They are the average interest rates for the entire Czech banking sector in CZK in the given month.

- The concept of new business and outstanding amounts

- In the case of specific indicators – overnight deposits, deposits redeemable at notice, bank overdrafts, revolving loans and credit card loans – the concept of new business is extended to the whole outstanding amount.