FX rates 23.04.2024

All FX rates

EUR - 25.265 CZK

USD - 23.672 CZK

GBP - 29.357 CZK

Read CNB Governor Aleš Michl’s selected speeches and interviews in which he explains how the central bank is fighting inflation and what steps it is taking to achieve price stability.

Key rates

4.75%

Discount Rate

5.75%

2W Repo Rate

1.75%

CCyB

Rate

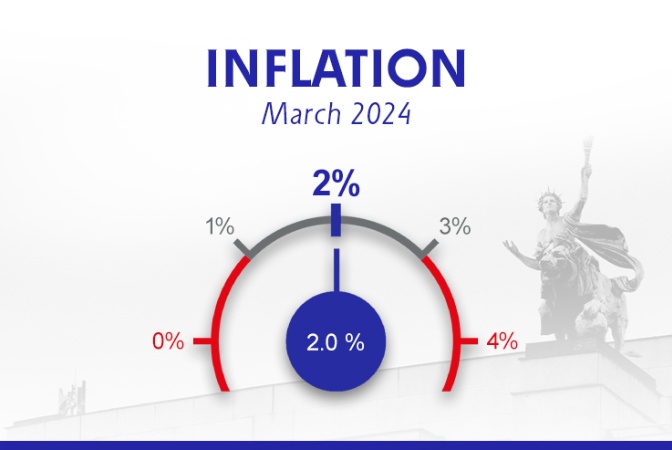

Inflation

2.0%

March 2024

CNB current forecast

2.6%

Inflation

2024

2.0%

Inflation

2025

0.6%

GDP

2024

2.4%

GDP

2025

Golden Rules for Bureau-de-Change Clients

- Change money only at designated bureaux de change. Before changing money, carefully read all the information given on the exchange rate list.

- The terms “purchase and sale of foreign currency” and the corresponding exchange rates, i.e. the information about the direction of the exchange, are given from the bureau de change’s perspective...

CNB resumes operation of services at its branches

- All branches and regional offices of the Czech National Bank will return to full operation, five days a week, from Monday, 14 December 2020.

- The standard opening hours for CNB clients and the public will be Monday to Friday from 7.30 am to 2.00 pm, with a lunch break from 11.30 am to 12.30 pm.

- Before your visit, you can check the opening hours for each of our offices on the CNB website (Prague, Brno, Ostrava, Plzeň, Hradec Králové, České Budějovice and Ústí nad Labem).

Upcoming events

24. 4.

25. 4.

30. 4.

30. 4.